Pensions

The City of Jersey Village is a member of Texas Municipal Retirement System (TMRS) a statewide, multiple employer agent plan. In an agent plan, each participating government’s pension is centrally administered and governed by state statutes but the assets and related pension liabilities for each government are accounted for separately and any unfunded liabilities are solely the obligation of that government.

Jersey Village's plan provides the following benefit level:

|

Employee Deposit Rate:

|

7% of pay

|

|

Matching Ration (City to Employee):

|

2 to 1

|

|

Service Retirement Eligibility

|

5 years at the age of 60 and above, 25 years at any age

|

|

Updated Service Credits:

|

100% Repeating Transfers

|

|

Cost of Living Adjustments:

|

70% of CPI

|

|

Years Required for Vesting:

|

5 years

|

|

Supplemental Death Benefits:

|

Yes

|

Most recently Completed Plan Year for which data is available is listed in the table below.

|

Funded Ratio |

Amortization Period in years |

Actuarially Determined Contribution Rate |

Actual Total Contribution Rate |

Unfunded Actuarial Accrued Liability as % of covered Payroll |

| 2023 |

85.38% |

22 |

|

|

61.42% |

| 2022 |

85.8% |

20.7 |

14.7% |

13.87% |

61% |

| 2021 |

87.4% |

21.9 |

13.97% |

14.32% |

54.4% |

| 2020 |

87.5% |

23.1 |

13.87% |

14.10% |

55.8% |

| 2019 |

86.6% |

24.1 |

13.75% |

13.97% |

59.8% |

| 2018 |

85.8% |

25.1 |

14.05% |

14.24% |

63.1% |

| 2017 |

82.5% |

26.1 |

15.51% |

15.51% |

81.4% |

| 2016 |

81.8% |

27.1 |

15.04% |

15.03% |

82.50% |

| 2015 |

80.9% |

28.1 |

15.35% |

15.43% |

82.30% |

| 2014 |

80.8% |

28.9 |

14.88% |

14.28% |

78.50% |

| 2013 |

77.7% |

30 |

15.25% |

14.24% |

89.40% |

| 2012 |

77.3% |

25.1 |

14.11% |

14.30% |

83.00% |

| 2011 |

74.1% |

26.1 |

|

|

92.50% |

|

TMRS Total Fund Return |

|

|

1 Year |

3 Years |

5 Years |

10 Years |

Assumed Rate of Return |

| 2023 |

11.64% |

5.29% |

7.79% |

6.15% |

6.75% |

| 2022 |

-7.35% |

4.1% |

4.81% |

5.98% |

6.75% |

| 2021 |

12.86% |

12.08% |

9.28% |

7.82% |

6.75% |

| 2020 |

7.65% |

6.46% |

7.99% |

6.74% |

6.75% |

| 2019 |

14.96% |

8.75% |

6.75% |

7.07% |

6.75% |

| 2018 |

-2.11% |

6.31% |

5.03% |

6.63% |

6.75% |

| 2017 |

14.27% |

7.19% |

7.46% |

6.71% |

6.75% |

| 2016 |

7.42% |

4.54% |

6.65% |

6.09% |

6.75% |

| 2015 |

0.34% |

5.29% |

5.63% |

5.42% |

6.75% |

| 2014 |

5.99% |

8.57% |

7.40% |

6.45% |

7.00% |

| 2013 |

9.86% |

7.40% |

8.29% |

7.14% |

7.00% |

| 2012 |

10.11% |

7.13% |

5.99% |

6.32% |

7.00% |

| 2011 |

2.41% |

7.17% |

5.54% |

6.99% |

7.00% |

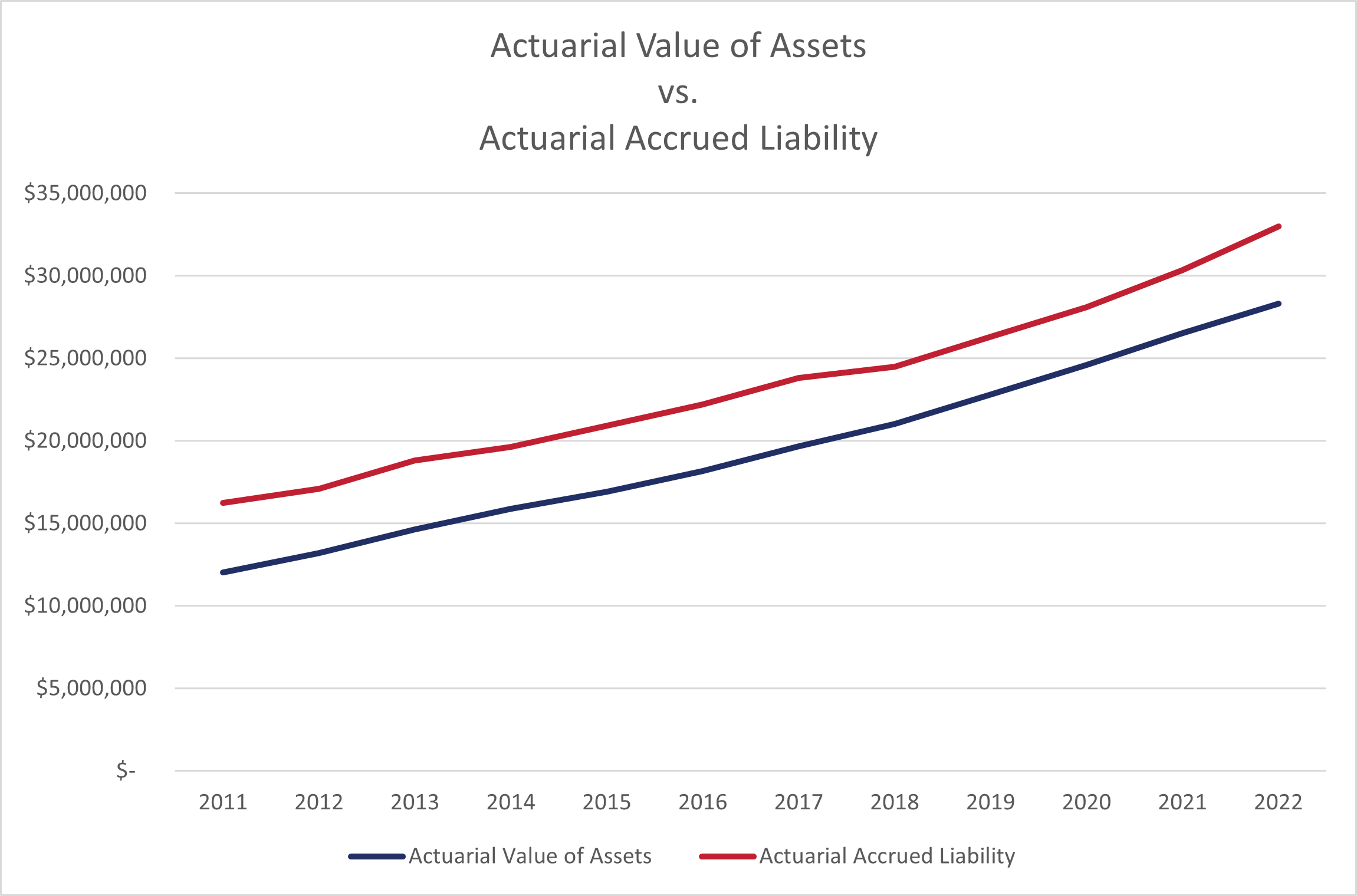

Actuarial Value of Assets versus Actuarial Accrued Liability

The graph below shows the time trend going back five years showing actuarial value of assets versus actuarial accrued liability.

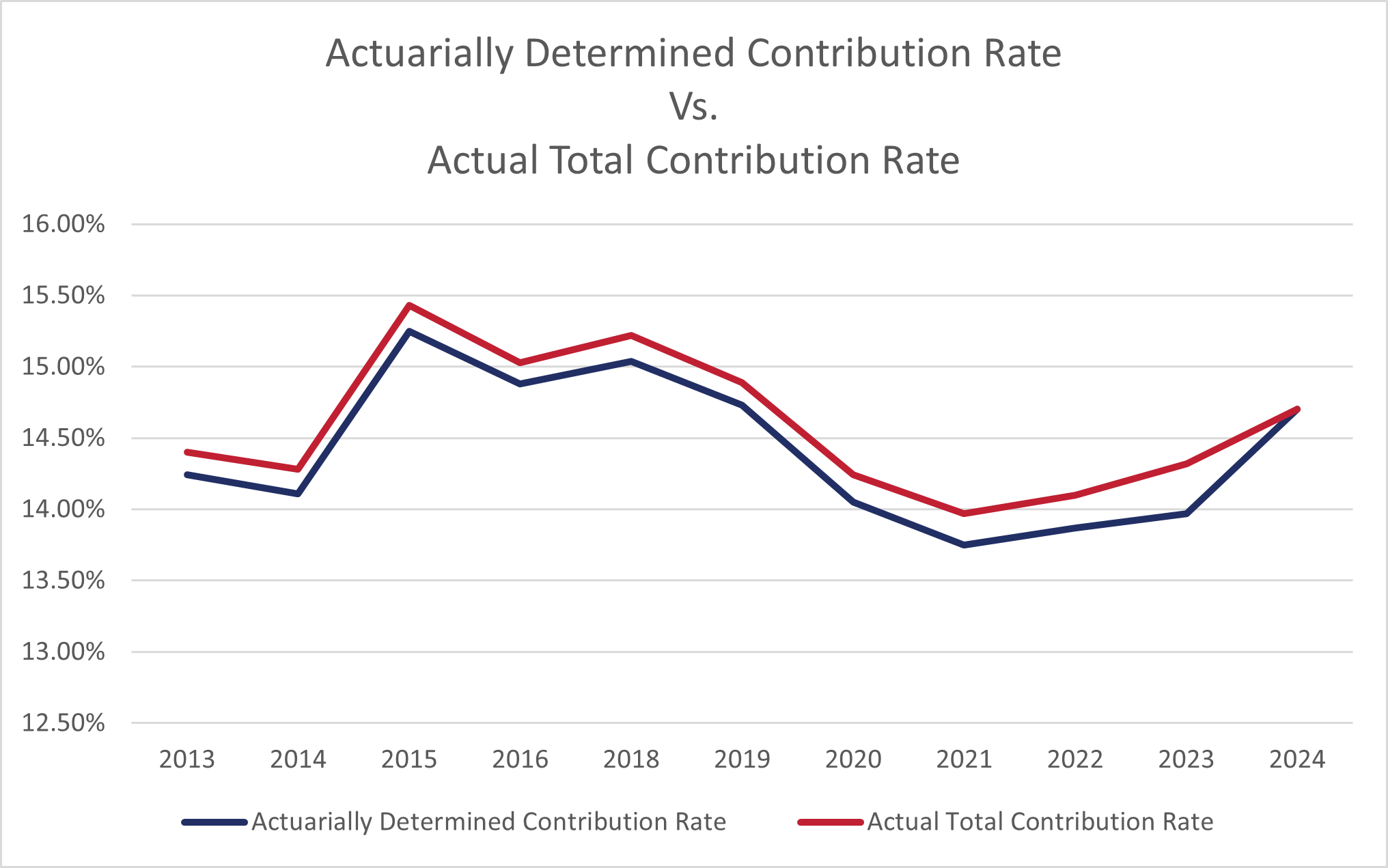

Actuarially Determined Contribution Rate vs. Actual Total Contribution Rate

The graph below shows the city contribution rate vs. the actuarially determined contribution rate. The employee contribution rate of 7% is not reflected in this graph.

Actuarial Valuations

|

Recent Audits

|

|

|

|

The following data is available in Excel format by clicking here.

- Actuarial value of assets versus actuarial accrued liability over time going back at least five fiscal years;

- Dataset(s) containing the following for the last five fiscal years:

- Total additions for the most recent valuation period by source, such as investment income, other income, employer, employee and other contributions; and

- Total deductions for the most recent valuation period by use such as benefit payments, withdrawals, administrative expenses and investment related expenses.

Link to Texas Comptroller of Public Accounts public pension search tool.

Click here to contact City Staff.

Click here to contact the Mayor and City Councilors

You can request copies of city records by following the instructions on this page.